Assets are one of the most fundamental concepts in accounting and financial management. They represent everything that a business owns or controls that can provide future economic benefits. In the context of accounting, assets are recorded on a company’s balance sheet and are categorized based on their liquidity, usability, and life span. This definition is crucial because it impacts how businesses report their financial health, make decisions, and comply with accounting standards.

This comprehensive exploration of assets in accounting covers their definition, types, recognition, classification, valuation, and relevance in financial reporting. It will also explain the relationship between assets and liabilities and discuss the broader role assets play in strategic decision-making.

What are Assets?

In accounting terms, an asset is a resource owned by a business or individual that is expected to provide future economic benefits. These resources can come in many forms, including cash, property, inventory, and intellectual property. Essentially, assets are the building blocks that help a business operate and grow. Whether tangible or intangible, assets play a critical role in achieving an organization’s objectives.

The International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) outline specific criteria for recognizing an asset, which must meet the following:

- Future Economic Benefit: The resource must provide future benefits. For example, owning a building allows a business to operate, generate income, or sell the property for profit.

- Control: The business must have control over the resource, meaning it has the right to use or sell it.

- Past Event: The asset must arise from a past transaction or event, such as purchasing equipment or acquiring land.

Types of Assets

Assets are generally classified into two broad categories: current assets and non-current assets. However, they can be further subdivided depending on their characteristics and use.

Current Assets

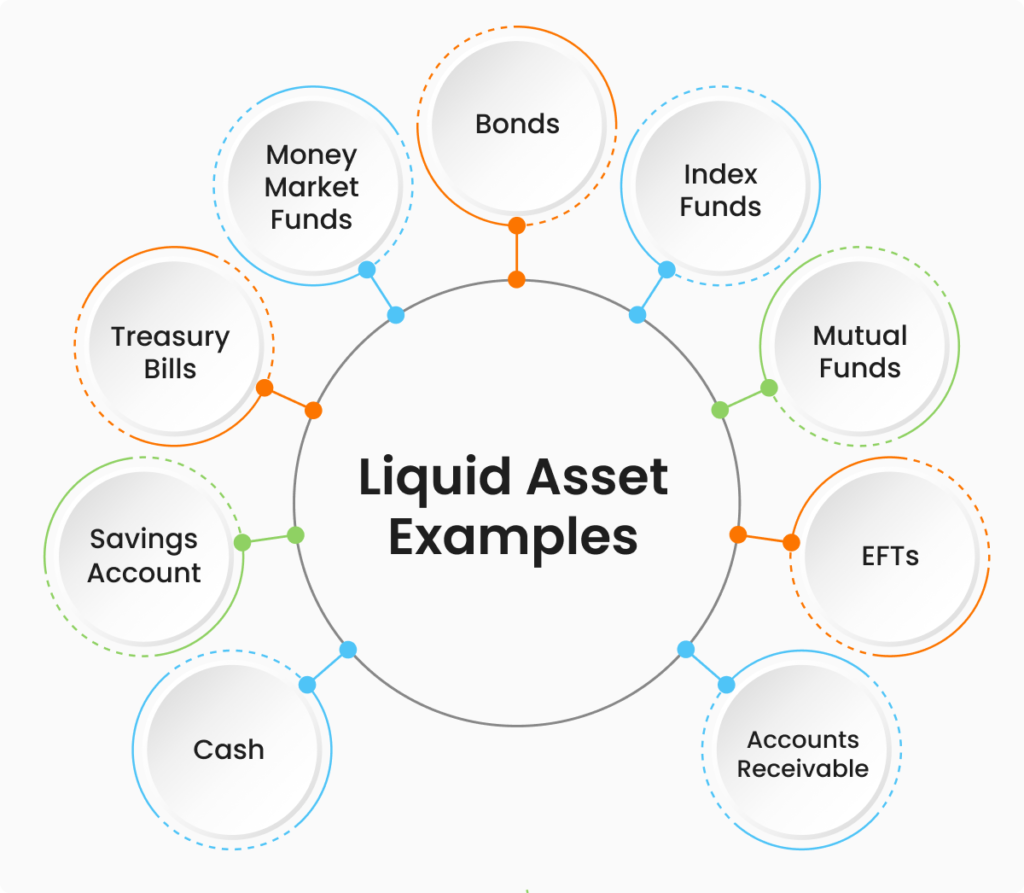

Current assets, also called short-term assets, are expected to be converted into cash or used up within a year (or within one operating cycle of the business, whichever is longer). They are the most liquid assets, meaning they can quickly be converted into cash. Examples include:

- Cash and Cash Equivalents: Money in hand, bank accounts, and highly liquid investments such as treasury bills.

- Accounts Receivable: Money owed by customers for goods or services that have been delivered or performed but not yet paid for.

- Inventory: Goods available for sale, raw materials, and work in progress that will eventually be sold or used in production.

- Prepaid Expenses: Payments made for goods or services that will be received in the future, such as insurance premiums or rent.

Non-Current Assets

Non-current assets, also known as long-term assets, are resources expected to provide economic benefits beyond one year. These assets are less liquid but essential for the ongoing operations and growth of the business. Non-current assets can be categorized into:

- Property, Plant, and Equipment (PP&E): These are tangible assets used in the production or supply of goods and services, such as land, buildings, machinery, and vehicles.

- Intangible Assets: Assets that lack physical substance but are valuable to the business, such as patents, trademarks, goodwill, and software.

- Investments: Long-term investments in stocks, bonds, or other businesses that the company intends to hold for more than a year.

- Deferred Tax Assets: These arise when a company has overpaid taxes or paid taxes in advance, and can use these amounts to reduce future tax liabilities.

Financial Assets

These represent ownership of another entity’s equity (e.g., stocks and bonds) or a financial right to receive cash (e.g., loans and receivables). These assets are typically classified as either short-term or long-term based on when they are expected to be realized.

Natural Resources

Certain types of assets are related to natural resources that are extracted and utilized in business operations, like oil reserves, minerals, or forests. These are often treated as a type of non-current asset and depreciated over time based on their use.

Recognition of Assets

In order for an asset to be recognized in financial statements, it must meet certain criteria. According to the IASB’s IFRS and the FASB’s GAAP, the criteria are:

- Probable Future Economic Benefit: The asset must have the potential to generate future income or cash flows.

- Control: The company must have control over the asset, which can include legal title or physical possession.

- Reliable Measurement: The cost or value of the asset can be reliably measured at the time of recognition.

Recognition also depends on whether the asset is acquired through a transaction or as part of a business combination, among other factors.

Valuation of Assets

Once an asset is recognized, its valuation is essential for accurate financial reporting. Valuation methods depend on the nature of the asset and the applicable accounting standards. Some common methods include:

- Historical Cost :- The historical cost principle involves recording the asset at its original cost, including all expenditures necessary to bring the asset into working condition. This method is commonly used for tangible assets such as machinery or property.

- Fair Value:- Fair value is the price at which an asset could be bought or sold in an orderly transaction between market participants. For assets that are traded on markets (e.g., stocks, bonds), fair value is easier to determine. However, for less liquid assets, estimating fair value can be more challenging.

- Market Value :- Market value refers to the price at which an asset could be sold on the open market. This method is typically used for assets that are actively traded, such as stocks or commodities.

- Revaluation Model:- In this method, non-current assets (e.g., property, plant, and equipment) are revalued to reflect their current market value. Changes in value are recognized in the financial statements, either in profit and loss or in other comprehensive income.

- Amortized Cost:- Amortized cost is often used for intangible assets or financial instruments, where the asset’s value is gradually reduced over time, either through depreciation or amortization.

- Net Realizable Value:- This is the expected selling price of an asset minus any costs to sell. It is commonly used for inventory valuation.

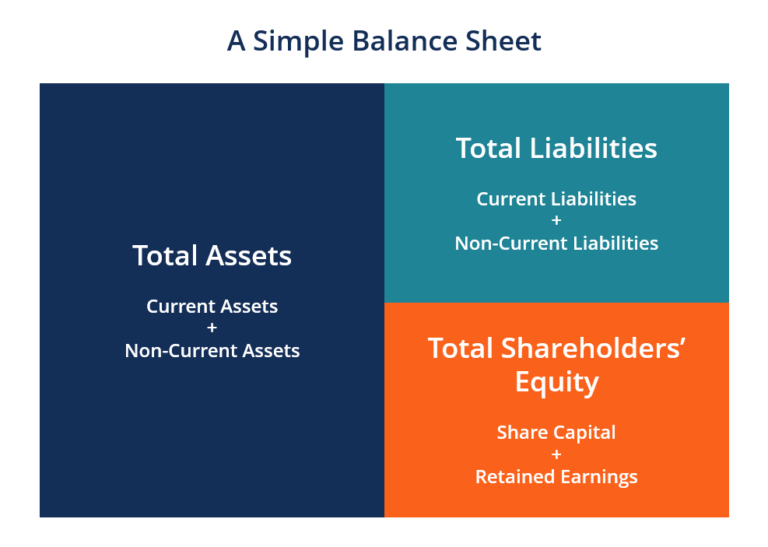

The Role of Assets in the Balance Sheet

Assets are reported on a company’s balance sheet, one of the key financial statements. The balance sheet adheres to the accounting equation:

Assets = Liabilities + Equity

This equation shows that the assets owned by a company are financed either through borrowing (liabilities) or through owners’ investments (equity). Understanding this equation is critical for analyzing a company’s financial stability and performance.

The classification of assets on the balance sheet is important because it provides insights into the company’s liquidity, operational efficiency, and long-term sustainability.

Depreciation and Amortization of Assets

For many non-current assets, the value will decrease over time due to wear and tear (tangible assets) or obsolescence (intangible assets). This decrease in value is accounted for through depreciation and amortization, respectively.

- Depreciation is the allocation of the cost of a tangible asset over its useful life. Common methods of depreciation include straight-line depreciation and declining balance depreciation.

- Amortization works similarly to depreciation but applies to intangible assets. It spreads the cost of an intangible asset over its useful life. Examples include patents, copyrights, and trademarks.

Depreciation and amortization are both non-cash expenses, meaning they do not affect cash flow directly. However, they reduce the book value of the assets and are deducted from the company’s income statement.

The Importance of Assets in Financial Reporting

Assets play a critical role in providing information to stakeholders, such as investors, creditors, and regulators. Through accurate accounting and reporting of assets, businesses demonstrate their financial position and ability to generate future economic benefits.

For investors, a company’s assets can indicate its ability to generate revenue, cover liabilities, and create value for shareholders. For creditors, the asset base is important for assessing the company’s ability to meet its obligations.

Accurate asset valuation and classification ensure transparency, aiding in decision-making processes both inside and outside the company.

Conclusion

Assets are essential to every business, providing the resources necessary to conduct operations, generate revenue, and grow. Understanding the different types of assets, their recognition, valuation, and depreciation methods is vital for accurate accounting and financial management. Assets not only impact a company’s balance sheet but also play a significant role in its strategy, long-term sustainability, and financial health.

In conclusion, assets form the foundation for the financial health of an organization. By properly managing and valuing assets, businesses ensure that they can make informed decisions, demonstrate financial performance, and meet their obligations, ultimately leading to long-term success and growth.